Pullbacks & Reversals: Stocks Setting Up for Big Moves!

In this video, Mary Ellen spotlights key pullback opportunities and reversal setups in the wake of a strong market week, one which saw all-time highs in the S&P 500 and Nasdaq. She breaks down the semiconductor surge and explores the…

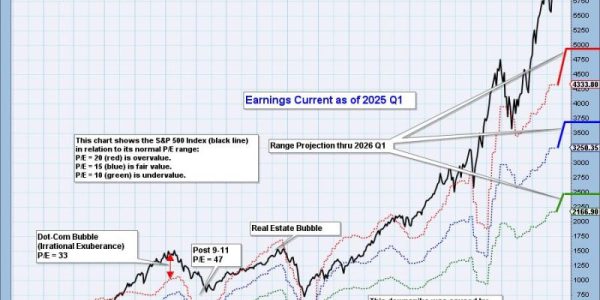

S&P 500 Earnings for 2025 Q1 — Still Overvalued

S&P 500 earnings are in for 2025 Q1, and here is our valuation analysis. The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have…

The Best Five Sectors, #25

A Greek Odyssey First of all, I apologize for any potential delays or inconsistencies this week. I’m currently writing this from a hotel room in Greece, surrounded by what I can only describe as the usual Greek chaos. Our flight…

Week Ahead: As NIFTY Breaks Out, Change Of Leadership Likely To Keep The Index Moving

After six weeks of consolidation and trading in a defined range, the markets finally broke out from this formation and ended the week with gains. Over the past five sessions, the markets have largely traded with a positive undercurrent, continuing…

3 Stock Setups for the Second Half of 2025

As we head into the second half of 2025, here are three stocks that present strong technical setups with favorable risk/reward profiles. One is the largest market cap stock we’re familiar with, which bodes well for the market in general….

How to Improve your Trading Odds and Increase Opportunities

Chartists can improve their odds and increase the number of opportunities by trading short-term bullish setups within bigger uptrends. The first order of business is to identify the long-term trend using a trend-following indicator. Second, chartist can turn to more…

Fibonacci Retracements: The Key to Identifying True Breakouts

If you’ve looked at enough charts over time, you start to recognize classic patterns that often appear. From head-and-shoulders tops to cup-and-handle patterns, they almost jump off the page when you bring up the chart. I would definitely include Fibonacci Retracements…

All-Time Highs and An Upcoming Rate Cut: We’re Just Getting Started on This Move Higher

The bears are now left grasping at straws. What about tariffs? What about inflation? What about recession? What about the Fed? What about interest rates? What about the Middle East? What about the deficits? Blah, blah, blah. When it comes…

Breakdown of NVDA’s Stock Price and S&P 500: Actionable Technical Insights

The S&P 500 ($SPX) just logged its second consecutive 1% gain on Tuesday. That’s three solid 1% advances so far in June. And with a few trading days remaining in the month, the index has recorded only one 1% decline…

Breakdown of NVDA’s Stock Price and S&P 500: Actionable Technical Insights

The S&P 500 ($SPX) just logged its second consecutive 1% gain on Tuesday. That’s three solid 1% advances so far in June. And with a few trading days remaining in the month, the index has recorded only one 1% decline…